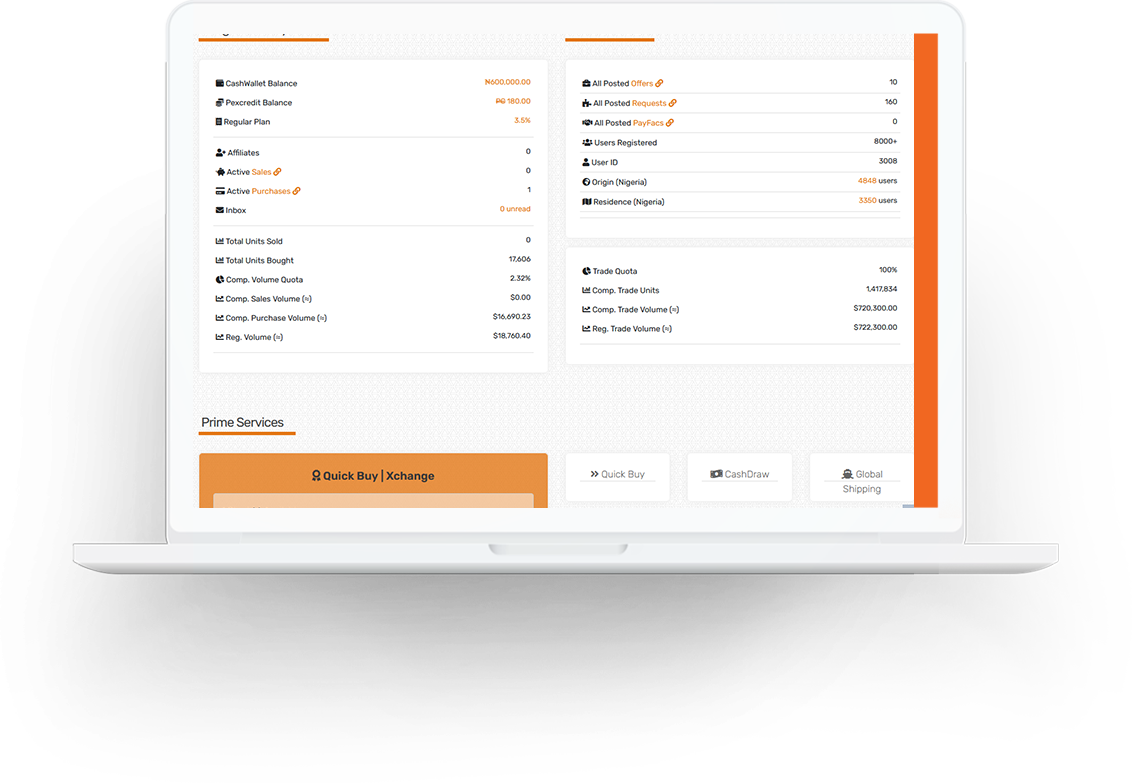

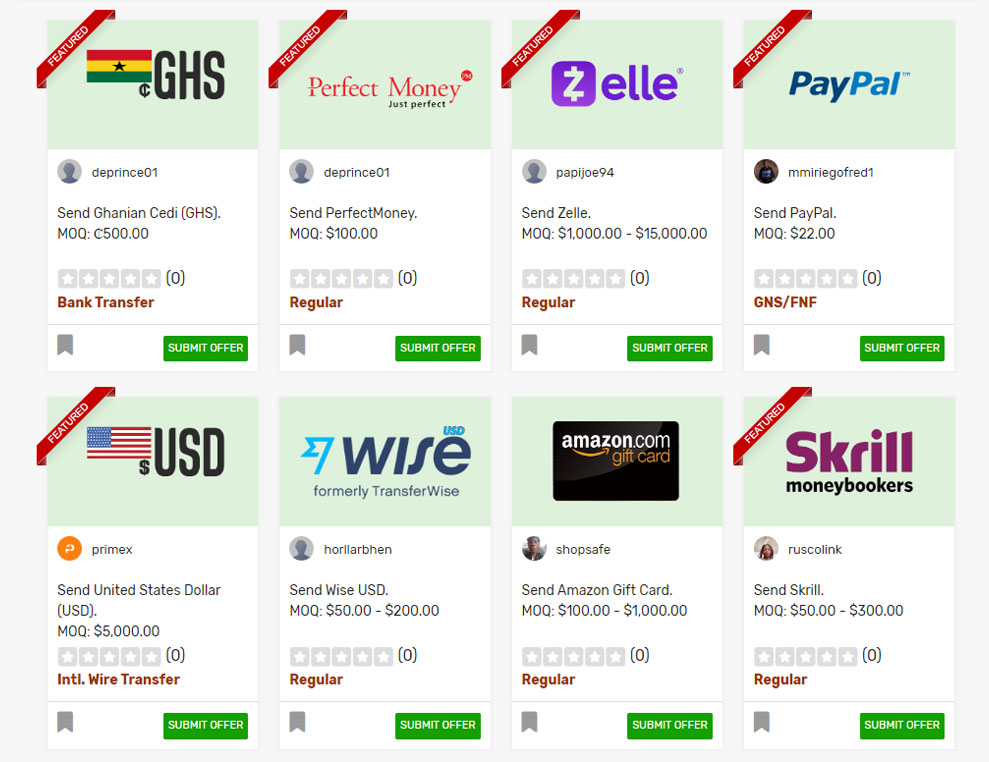

switching payment services

Engage Multiple Options

Citizens in the diaspora can offer or facilitate payments using various options, seamlessly switching payment services for entrepreneurs & businesses alike to meet local payment demands within the diaspora geography.